All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash money value of an IUL are usually tax-free up to the amount of premiums paid. Any withdrawals over this amount might be subject to taxes relying on policy framework. Conventional 401(k) payments are made with pre-tax dollars, lowering taxed income in the year of the contribution. Roth 401(k) contributions (a plan attribute readily available in a lot of 401(k) strategies) are made with after-tax payments and after that can be accessed (earnings and all) tax-free in retired life.

Withdrawals from a Roth 401(k) are tax-free if the account has actually been open for at the very least 5 years and the individual is over 59. Possessions withdrawn from a conventional or Roth 401(k) before age 59 might incur a 10% fine. Not specifically The cases that IULs can be your own financial institution are an oversimplification and can be misleading for several reasons.

Nevertheless, you might undergo upgrading associated health and wellness concerns that can impact your ongoing costs. With a 401(k), the cash is constantly your own, including vested company matching regardless of whether you give up adding. Threat and Assurances: Most importantly, IUL policies, and the cash value, are not FDIC guaranteed like conventional savings account.

While there is generally a floor to avoid losses, the growth capacity is covered (suggesting you might not totally gain from market increases). Many specialists will certainly concur that these are not equivalent items. If you want survivor benefit for your survivor and are concerned your retirement savings will certainly not suffice, after that you might intend to think about an IUL or other life insurance item.

Certain, the IUL can give accessibility to a cash account, however once again this is not the key purpose of the product. Whether you want or require an IUL is a highly private inquiry and depends on your primary financial objective and goals. Nonetheless, listed below we will attempt to cover advantages and constraints for an IUL and a 401(k), so you can further delineate these items and make a more enlightened choice concerning the most effective means to handle retirement and looking after your enjoyed ones after death.

John Hancock Protection Iul

Finance Expenses: Fundings versus the plan build up rate of interest and, if not paid back, reduce the survivor benefit that is paid to the beneficiary. Market Participation Limits: For the majority of plans, investment development is tied to a stock exchange index, but gains are typically capped, limiting upside prospective - iul for. Sales Practices: These plans are commonly marketed by insurance coverage representatives who may emphasize advantages without fully explaining expenses and risks

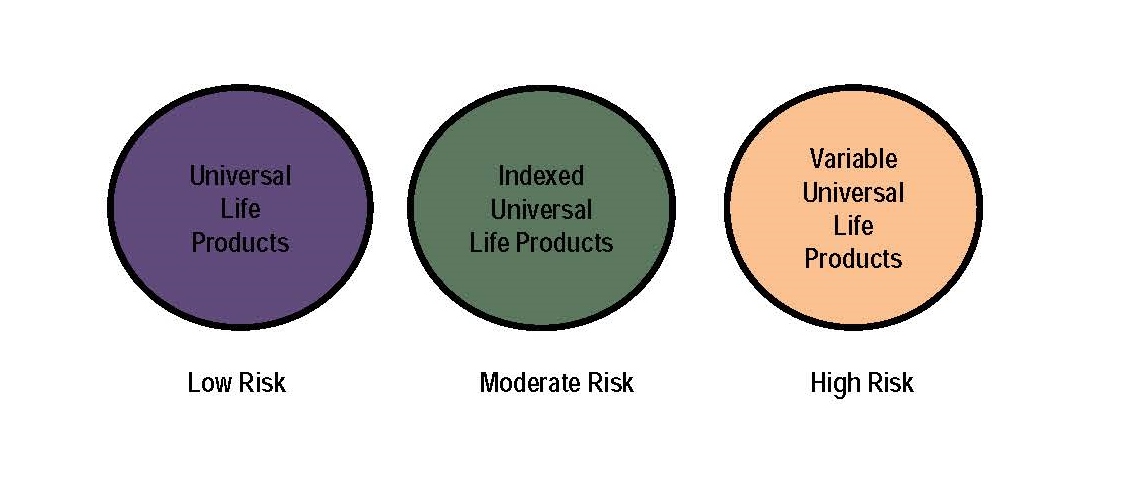

While some social media pundits suggest an IUL is an alternative item for a 401(k), it is not. Indexed Universal Life (IUL) is a type of permanent life insurance coverage policy that also offers a cash value part.

Latest Posts

Iul Life Insurance

Global Indexed Universal Life Insurance

Symetra Iul