All Categories

Featured

[/image][=video]

[/video]

This can result in much less benefit for the insurance holder compared to the monetary gain for the insurance coverage company and the agent.: The illustrations and presumptions in advertising and marketing materials can be misleading, making the plan appear a lot more eye-catching than it may really be.: Know that economic advisors (or Brokers) earn high commissions on IULs, which could influence their suggestions to sell you a plan that is not ideal or in your finest rate of interest.

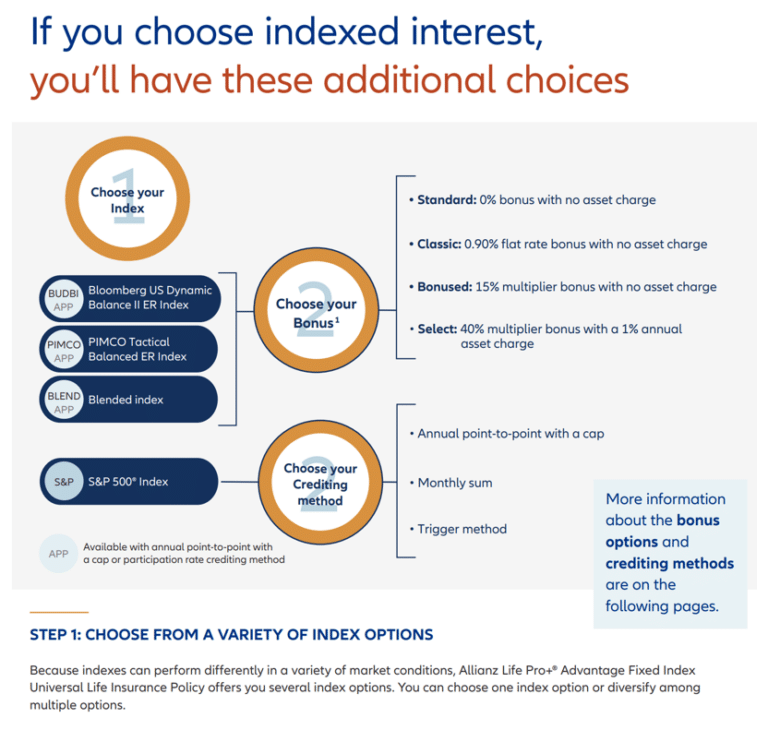

The majority of account choices within IUL products ensure among these limiting variables while enabling the other to drift. The most typical account alternative in IUL plans features a floating yearly passion cap in between 5% and 9% in existing market conditions and a guaranteed 100% engagement rate. The rate of interest made amounts to the index return if it is much less than the cap however is capped if the index return surpasses the cap price.

Various other account alternatives could include a floating engagement price, such as 50%, without cap, meaning the rate of interest credited would certainly be half the return of the equity index. A spread account credit histories interest above a floating "spread price." For instance, if the spread is 6%, the rate of interest attributed would certainly be 15% if the index return is 21% but 0% if the index return is 5%.

Interest is typically attributed on an "yearly point-to-point" basis, indicating the gain in the index is determined from the factor the premium entered the account to precisely one year later. All caps and engagement prices are after that used, and the resulting passion is credited to the plan. These rates are adjusted annually and utilized as the basis for computing gains for the following year.

Rather, they utilize options to pay the rate of interest guaranteed by the IUL agreement. A telephone call choice is a monetary agreement that offers the option purchaser the right, however not the commitment, to purchase a property at a specified price within a certain amount of time. The insurer purchases from an investment bank the right to "get the index" if it goes beyond a certain degree, called the "strike price."The carrier could hedge its capped index liability by acquiring a call alternative at a 0% gain strike cost and composing a telephone call alternative at an 8% gain strike cost.

Iul Calculator

The budget that the insurer has to acquire choices depends upon the yield from its general account. For example, if the provider has $1,000 internet costs after deductions and a 3% yield from its basic account, it would assign $970.87 to its basic account to expand to $1,000 by year's end, using the staying $29.13 to purchase options.

The two largest variables influencing floating cap and involvement rates are the returns on the insurance coverage business's general account and market volatility. As returns on these possessions have actually declined, providers have actually had smaller budgets for acquiring choices, leading to minimized cap and participation prices.

Service providers typically illustrate future performance based on the historical performance of the index, applying existing, non-guaranteed cap and engagement prices as a proxy for future efficiency. Nevertheless, this approach might not be practical, as historic estimates frequently mirror greater previous passion rates and presume regular caps and involvement rates regardless of varied market conditions.

A far better strategy could be assigning to an uncapped involvement account or a spread account, which involve acquiring relatively cost-effective choices. These techniques, nonetheless, are much less stable than capped accounts and might call for frequent modifications by the provider to show market problems accurately. The narrative that IULs are traditional items providing equity-like returns is no longer lasting.

With reasonable assumptions of choices returns and a diminishing spending plan for acquiring options, IULs might provide partially higher returns than standard ULs however not equity index returns. Possible purchasers must run illustrations at 0.5% above the rates of interest attributed to traditional ULs to evaluate whether the plan is correctly moneyed and efficient in providing guaranteed efficiency.

As a relied on companion, we collaborate with 63 premier insurance provider, ensuring you have access to a diverse series of alternatives. Our solutions are totally complimentary, and our professional advisors give objective advice to aid you discover the most effective coverage customized to your demands and budget. Partnering with JRC Insurance policy Team means you receive tailored solution, affordable rates, and assurance knowing your economic future remains in capable hands.

Equity Index Universal Life Insurance

We assisted thousands of households with their life insurance requires and we can aid you too. Expert evaluated by: High cliff is an accredited life insurance representative and one of the proprietors of JRC Insurance Group.

In his leisure he appreciates spending quality time with household, taking a trip, and the open airs.

Variable policies are financed by National Life and dispersed by Equity Providers, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Firm, One National Life Drive, Montpelier, Vermont 05604. Be certain to ask your financial advisor regarding the lasting treatment insurance coverage policy's attributes, benefits and costs, and whether the insurance coverage is suitable for you based on your economic scenario and purposes. Handicap revenue insurance normally supplies month-to-month revenue advantages when you are unable to work due to a disabling injury or ailment, as defined in the policy.

Cash value grows in a global life plan with credited passion and decreased insurance coverage costs. If the policy lapses, or is surrendered, any kind of outstanding superior fundings taken into consideration in the policy may be subject to ordinary normal earnings. A dealt with indexed global life insurance (FIUL)plan is a life insurance product that provides gives the opportunity, when adequately effectively, to participate take part the growth development the market or an index without directly investing spending the market.

Latest Posts

Iul Life Insurance

Global Indexed Universal Life Insurance

Symetra Iul